"The Federal Reserve raising short-term rates and signaling further increases means mortgage rates should continue to rise over the course of the year," said Sam Khater, Freddie Mac’s chief economist, in a statement. As a result, expect mortgage rates to continue on an upward trend. The Fed also indicated an additional six rate increases are likely in 2022, bringing the federal fund rate to 1.9% by year's end. It's the first time the Fed has increased interest rates since December 2018 and almost two-years to the day since the central bank dropped rates in response the coronavirus pandemic. The hotly-anticipated increase in the Federal Reserve's benchmark interest rate came to pass yesterday.Īt the conclusion of its Federal Open Market Committee meeting, the Federal Reserve announced a quarter of a percentage point increase in the federal funds rate, effectively raising the interest rate at which banks lend to each other from 0%-0.25% to 0.25%-0.50%. Get Started The latest information on current mortgage rates Will current mortgage rates last?

#FREDDIE MAC INTEREST RATES TODAY FREE#

Click below and request your free quote today. Closing costs generally run between 2% and 5% and the sale prices. Some buyers finance their new home's closing costs into the loan, which adds to the debt and increases monthly payments. FHA borrowers pay a mortgage insurance premium throughout the life of the loan. Borrowers with conventional loans can avoid private mortgage insurance by making a 20% down payment or reaching 20% home equity. Mortgage insurance costs up to 1% of your home loan's value per year. Check with your real estate agent to get an estimate of these costs. Homeowners' insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. With a fixed-rate loan payments remain the same throughout the life of the loan.

The mortgage rates on adjustable-rate mortgages reset regularly (after an introductory period) and monthly payments change with it. Other factors that determine how much you'll pay each month include:Ĭhoosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables. You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. At 8% interest rate = $1,468 in monthly payments (not including taxes, insurance, or HOA fees).At 6% interest rate = $1,199 in monthly payments (not including taxes, insurance, or HOA fees).At 4% interest rate = $955 in monthly payments (not including taxes, insurance, or HOA fees).At 3% interest rate = $843 in monthly payments (not including taxes, insurance, or HOA fees).On a $200,000 home loan with a fixed rate for 30 years: If you bought a $250,000 home and made a 20% down payment - $50,000 - you would end up with a starting loan balance of $200,000. The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

Today’s mortgage rates and your monthly payment The average rate was 2.79% this time last year.

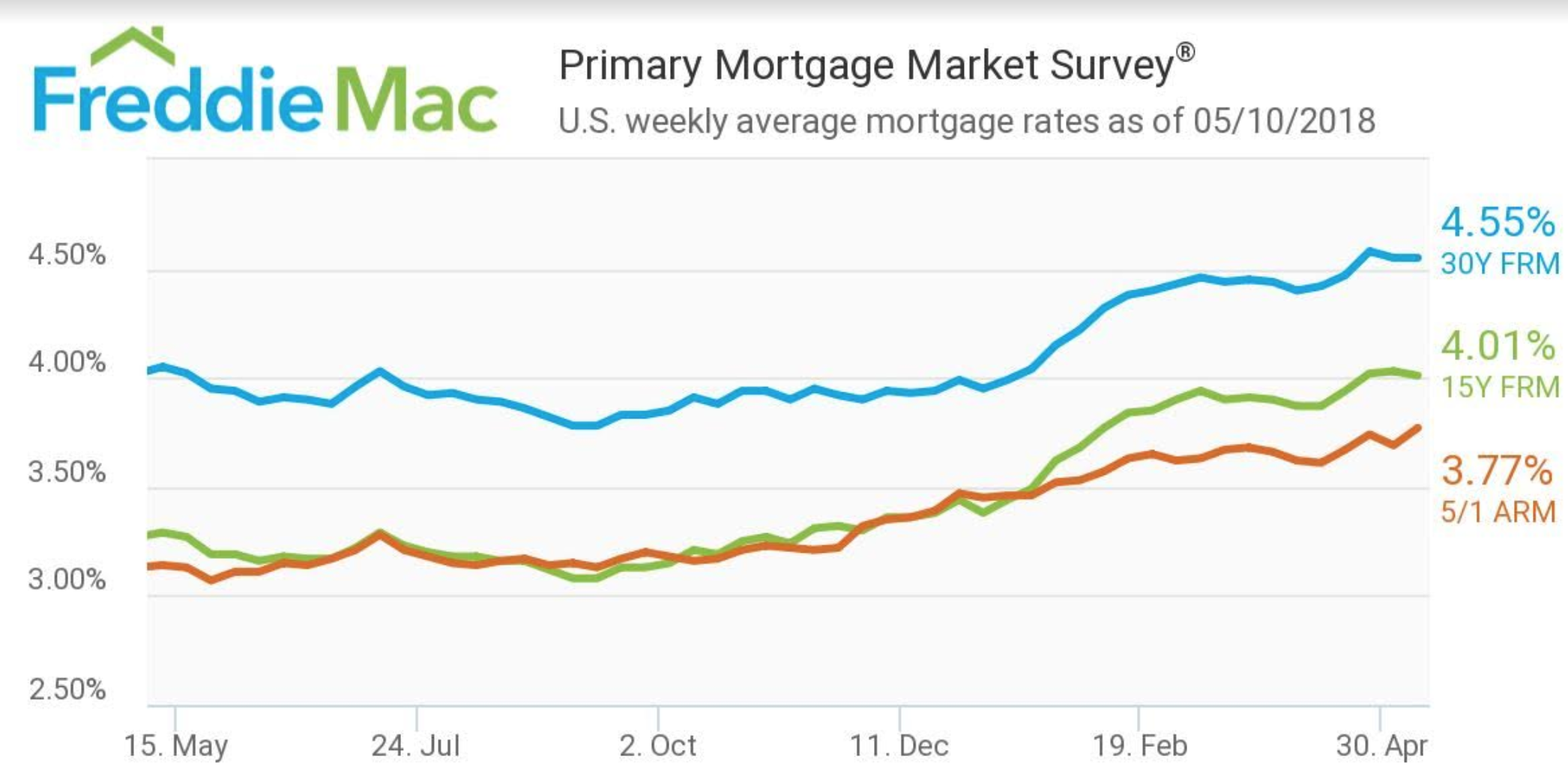

Keep in mind that available rates vary by lender and change constantly. On the other hand, Money's daily mortgage rate survey is based on the previous day's lending activity and represents the average rate a borrower with a 700 credit score and 20% down should expect. Borrowers with lower credit scores will generally be offered higher rates. The average rate represents roughly the rate a borrower with strong credit and a 20% down payment can expect to see when applying for a mortgage right now. That's a massive 0.31 percentage point increase from last week's average and the first time the average 30-year rate has been above 4% since May of 2019.įor its rate survey, Freddie Mac looks at rates offered for the week ending each Thursday. The average rate on a 30-year fixed-rate mortgage jumped to 4.16% this week, according to Freddie Mac.

0 kommentar(er)

0 kommentar(er)